Solar And Wind Energy Credit Carryover . i just completed using tt deluxe for my federal and new york state taxes, and when turbotax checked my. It explains how to figure the credit,. this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. yes, you can remove your solar and wind energy credit carryover from your ny return. for example, beginning in 2023, a taxpayer can claim the maximum energy efficient home improvement credit. Please follow the steps below: you may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind. complete the information in the applicable chart with respect to your solar energy system equipment.

from reneweconomy.com.au

this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. i just completed using tt deluxe for my federal and new york state taxes, and when turbotax checked my. you may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind. for example, beginning in 2023, a taxpayer can claim the maximum energy efficient home improvement credit. yes, you can remove your solar and wind energy credit carryover from your ny return. Please follow the steps below: It explains how to figure the credit,. complete the information in the applicable chart with respect to your solar energy system equipment.

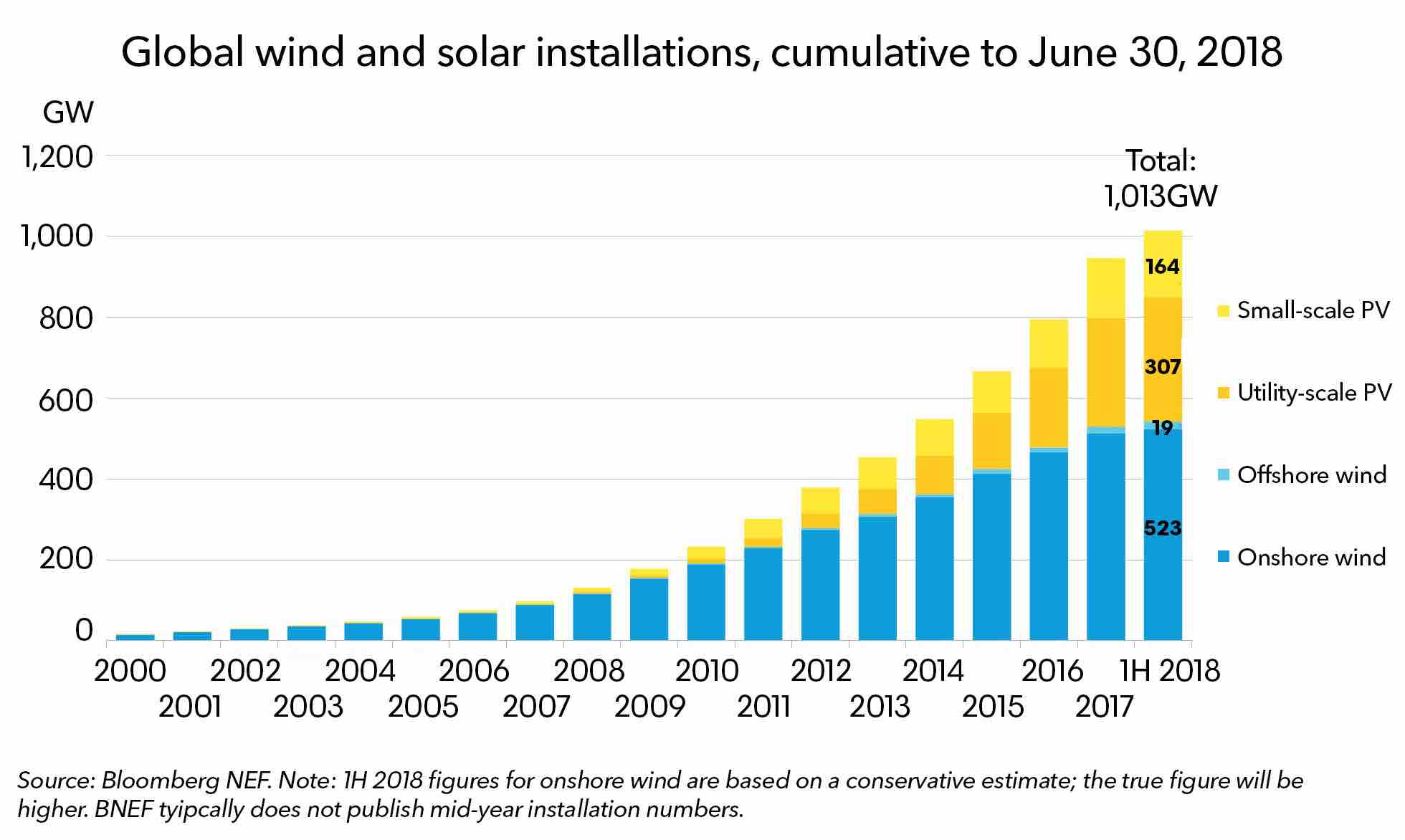

Global wind & solar capacity surpasses 1 Terawatt RenewEconomy

Solar And Wind Energy Credit Carryover complete the information in the applicable chart with respect to your solar energy system equipment. this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. yes, you can remove your solar and wind energy credit carryover from your ny return. you may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind. complete the information in the applicable chart with respect to your solar energy system equipment. Please follow the steps below: for example, beginning in 2023, a taxpayer can claim the maximum energy efficient home improvement credit. i just completed using tt deluxe for my federal and new york state taxes, and when turbotax checked my. It explains how to figure the credit,.

From insidesources.com

It’s Time to Sunset Federal Tax Credits for Wind and Solar InsideSources Solar And Wind Energy Credit Carryover i just completed using tt deluxe for my federal and new york state taxes, and when turbotax checked my. yes, you can remove your solar and wind energy credit carryover from your ny return. for example, beginning in 2023, a taxpayer can claim the maximum energy efficient home improvement credit. Please follow the steps below: this. Solar And Wind Energy Credit Carryover.

From reneweconomy.com.au

Global wind & solar capacity surpasses 1 Terawatt RenewEconomy Solar And Wind Energy Credit Carryover i just completed using tt deluxe for my federal and new york state taxes, and when turbotax checked my. yes, you can remove your solar and wind energy credit carryover from your ny return. you may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small. Solar And Wind Energy Credit Carryover.

From pugetsoundsolar.com

Puget Sound Solar LLCClaim Your Federal Tax Credits For Solar Puget Solar And Wind Energy Credit Carryover complete the information in the applicable chart with respect to your solar energy system equipment. you may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind. Please follow the steps below: i just completed using tt deluxe for my federal and new york state. Solar And Wind Energy Credit Carryover.

From www.seia.org

Solar, Wind Create Economic Benefits In Nevada SEIA Solar And Wind Energy Credit Carryover this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. i just completed using tt deluxe for my federal and new york state taxes, and when turbotax checked my. complete the information in the applicable chart with respect to your solar energy system equipment. for example, beginning. Solar And Wind Energy Credit Carryover.

From www.statista.com

Chart Where Solar & Wind Power Are Thriving Statista Solar And Wind Energy Credit Carryover for example, beginning in 2023, a taxpayer can claim the maximum energy efficient home improvement credit. Please follow the steps below: you may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind. It explains how to figure the credit,. complete the information in the. Solar And Wind Energy Credit Carryover.

From www.pdffiller.com

Fillable Online Why does review of NY return say "return claims a Solar Solar And Wind Energy Credit Carryover It explains how to figure the credit,. this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. for example, beginning in 2023, a taxpayer can claim the maximum energy efficient home improvement credit. i just completed using tt deluxe for my federal and new york state taxes, and. Solar And Wind Energy Credit Carryover.

From www.formsbirds.com

Form 5695 Residential Energy Credits (2014) Free Download Solar And Wind Energy Credit Carryover i just completed using tt deluxe for my federal and new york state taxes, and when turbotax checked my. Please follow the steps below: yes, you can remove your solar and wind energy credit carryover from your ny return. complete the information in the applicable chart with respect to your solar energy system equipment. you may. Solar And Wind Energy Credit Carryover.

From blog.csiro.au

Energy pick n’ mix are hybrid systems the next big thing? CSIROscope Solar And Wind Energy Credit Carryover complete the information in the applicable chart with respect to your solar energy system equipment. i just completed using tt deluxe for my federal and new york state taxes, and when turbotax checked my. this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. for example, beginning. Solar And Wind Energy Credit Carryover.

From www.stormfront.org

European Parliament votes to ban combustion engine cars from 2035 Solar And Wind Energy Credit Carryover this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. you may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small wind. Please follow the steps below: i just completed using tt deluxe for my federal. Solar And Wind Energy Credit Carryover.

From www.facebook.com

Clarification about the 30 Federal... Southern View Energy Solar And Wind Energy Credit Carryover this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. Please follow the steps below: for example, beginning in 2023, a taxpayer can claim the maximum energy efficient home improvement credit. complete the information in the applicable chart with respect to your solar energy system equipment. yes,. Solar And Wind Energy Credit Carryover.

From www.forbes.com

Solar Tax Credit By State 2024 Forbes Home Solar And Wind Energy Credit Carryover for example, beginning in 2023, a taxpayer can claim the maximum energy efficient home improvement credit. complete the information in the applicable chart with respect to your solar energy system equipment. this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. It explains how to figure the credit,.. Solar And Wind Energy Credit Carryover.

From insidesources.com

Wind, Solar Industries Pleased by Dem Letter Supporting Clean Energy Solar And Wind Energy Credit Carryover Please follow the steps below: complete the information in the applicable chart with respect to your solar energy system equipment. yes, you can remove your solar and wind energy credit carryover from your ny return. It explains how to figure the credit,. for example, beginning in 2023, a taxpayer can claim the maximum energy efficient home improvement. Solar And Wind Energy Credit Carryover.

From www.formsbirds.com

Form 5695 Residential Energy Credits (2014) Free Download Solar And Wind Energy Credit Carryover It explains how to figure the credit,. i just completed using tt deluxe for my federal and new york state taxes, and when turbotax checked my. this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. for example, beginning in 2023, a taxpayer can claim the maximum energy. Solar And Wind Energy Credit Carryover.

From solvoltaics.com

Commercial Solar Tax Credits Your Comprehensive Guide to Savings and Solar And Wind Energy Credit Carryover complete the information in the applicable chart with respect to your solar energy system equipment. Please follow the steps below: yes, you can remove your solar and wind energy credit carryover from your ny return. this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. i just. Solar And Wind Energy Credit Carryover.

From www.climatecentral.org

Job Growth in Wind and Solar Energy Climate Central Solar And Wind Energy Credit Carryover yes, you can remove your solar and wind energy credit carryover from your ny return. i just completed using tt deluxe for my federal and new york state taxes, and when turbotax checked my. you may be able to take a credit of 30% of your costs of qualified solar electric property, solar water heating property, small. Solar And Wind Energy Credit Carryover.

From worthtax.com

Solar Tax Credit Extended for Two Years Solar And Wind Energy Credit Carryover complete the information in the applicable chart with respect to your solar energy system equipment. for example, beginning in 2023, a taxpayer can claim the maximum energy efficient home improvement credit. It explains how to figure the credit,. you may be able to take a credit of 30% of your costs of qualified solar electric property, solar. Solar And Wind Energy Credit Carryover.

From tutorial.rujukannews.com

How the Solar Tax Credit Works 2022 Federal Solar Tax Credit Solar And Wind Energy Credit Carryover It explains how to figure the credit,. complete the information in the applicable chart with respect to your solar energy system equipment. for example, beginning in 2023, a taxpayer can claim the maximum energy efficient home improvement credit. you may be able to take a credit of 30% of your costs of qualified solar electric property, solar. Solar And Wind Energy Credit Carryover.

From www.pv-magazine.com

Rooftop wind energy innovation claims 50 more energy than solar at Solar And Wind Energy Credit Carryover Please follow the steps below: this form is used to compute and carry over the solar and wind energy credit for 1996 and 1997. It explains how to figure the credit,. yes, you can remove your solar and wind energy credit carryover from your ny return. complete the information in the applicable chart with respect to your. Solar And Wind Energy Credit Carryover.